Wipro is one of the major IT companies in the country and leads a massive role in the global digital transformation landscape. As we are heading towards 2025, investors are curious to know about Wipro Share Price Target 2025 and future growth. With its pleasing stand in IT services and healthy growth strategy, the outlook for Wipro looks pretty good, attracting market watchdogs along with long-term investors.

What is Wipro?

Wipro was set up in 1945 as a small company producing vegetable and refined oils under the banner of Western India Vegetable Products Limited. Over time, this diversified to offer IT services and consultancy as one of the top software companies in India. The Wipro saga from humble beginnings in consumer goods to today’s IT giant globally is inspiring, showing flexibility and prudence. Today, this company renders a wide range of services, including digital strategy to cloud computing, cybersecurity, artificial intelligence, and much more, thereby becoming the crown jewel in the digital revolution. For more Detail visit https://www.wipro.com/.

- Fun Fact: Wipro was one among the first companies from India that ever ventured into the IT service and now it is active in more than 50 countries.

Wipro Share Price In Recent: 2024 Analysis

Here is the data in table format:

| Date and Time | Price (INR) | Change | Change % |

|---|---|---|---|

| 8 Nov, 3:30 pm IST | 568.60 | +5.20 | +0.92% |

| Market Data | Value |

|---|---|

| Open | 565.00 |

| High | 578.80 |

| Low | 565.00 |

| Market Cap | 2.97L Cr |

| P/E Ratio | 25.37 |

| Dividend Yield | 0.18% |

| CDP Score | A- |

| 52-Week High | 579.90 |

| 52-Week Low | 377.00 |

Wipro Share Price Target 2025: Overview

Wipro share price target 2025 growth is estimated between ₹591.81 and ₹674.68, mainly because of growing demand in the transformation and automation domains in the company.

Wipro is listed on NSE and BSE besides New York Stock Exchange (NYSE). Thus, it has been one of the most-preferred stocks among domestic as well as international investors. Company’s stock value has remarkably been stable along with a consistent revenue stream due to IT services.

Wipro shares have always been excellent investment options due to stability during economic downswings. It serves as a premier investment for conservative stock market investors.

Wipro Share Price Target 2025 to 2023: Comparison and Future Forecast

Wipro’s stock price has been rising steadily over the past few years. It is likely that its current strong phase of digital transformation, artificial intelligence, and cloud services will keep driving growth into the future. Here’s a comparison:

- 2023: ₹500-₹540

- 2025: ₹591.81-₹674.68

- 2030: ₹850-₹1000 range; driven by emerging technologies and global market expansion.

Here’s the table based on the Wipro Share Price Target From 2025 to 2023

| Year | Share Price Target (₹) |

|---|---|

| 2025 | ₹680 |

| 2026 | ₹733 |

| 2027 | ₹773 |

| 2028 | ₹823 |

| 2029 | ₹872 |

| 2030 | ₹950 |

With continuous investment in innovation, there is promise for Wipro in regards to 2025, particularly in areas such as AI, cybersecurity, and sustainable business models.

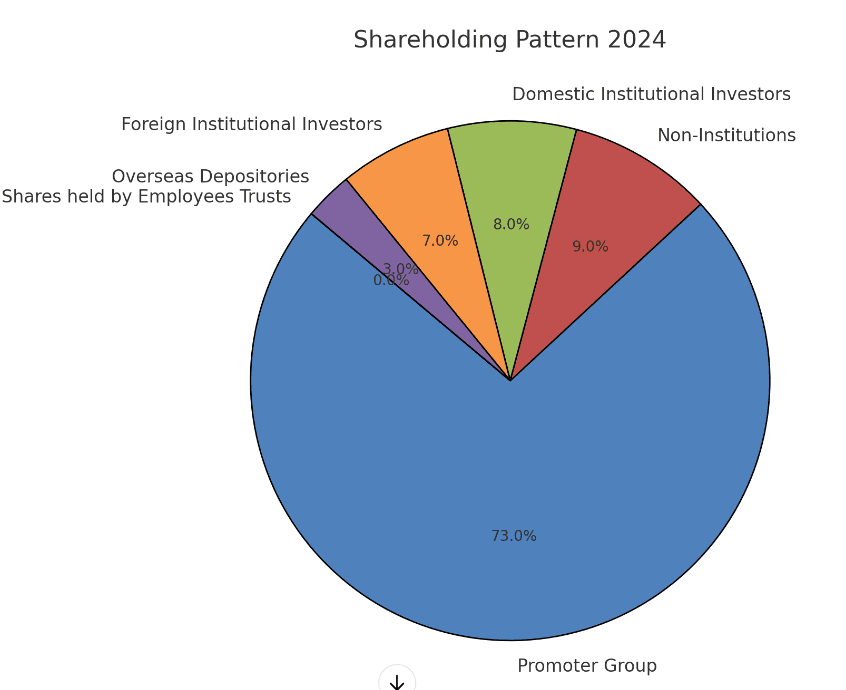

Wipro Share Price Shareholding Data

Here is the shareholding pattern data of Wipro Share Price.

| Category | Percentage |

|---|---|

| Promoter Group | 73% |

| Non-Institutions | 9% |

| Domestic Institutional Investors | 8% |

| Foreign Institutional Investors | 7% |

| Overseas Depositories | 3% |

| Shares held by Employees Trusts | 0% |

Future Scope of Investment In Wipro: Profit and Loss Areas

Wipro investing has both a set of potential benefits and risks. Here is the outline of what to expect:

Profit Areas:

- High demand for the services of digital transformation due to enhanced global adoption of AI and cloud technologies.

- Stable and predictable revenues through long-term contracts with large clients primarily from the United States and Europe.

- Further penetration into new markets and service lines, including green IT solutions.

Loss Categories:

- Global IT majors such as Accenture, Infosys, and TCS may put downward pressure on profit margins.

- Volatility in exchange rates of currencies may impact revenues in international markets, especially in economies known for their volatility.

- Slowing down of the global economy or a disruption in the key markets may weigh on growth.

Conclusion

Wipro share price forms a very attractive investment opportunity before investors, especially those seeking long-term growth. It has a strong presence in the space of digital transformation and has excellent prospects to benefit from the various waves of technological innovation. But market risks and competition shall be the investors’ prime concern. Wipro thus remains a stable and a promising investment for the future.