Tata Power is the flagship utility company for India’s leading private enterprise in the space of power, focusing on renewable energy, distribution, and sustainable power solutions. As such, when the investor eye is turned to this share, it becomes patently obvious that green initiatives along with growth in steadiness make it one of the most attractive stocks for cautious investors and a forward-looking kind as well. And here we will discuss the about Tata Power Share Price Target 2025 to 2030 with comprehensive data.

What is Tata Power?

Tata Power was founded in 1911, making it one of the oldest and most important power companies in India. The company is a subsidiary of the Tata Group, evolving from traditional coal-based power generation to become a leader in renewable energy.

The company’s portfolio now comprises hydro, wind, and solar power projects, innovations in battery storage, and electric vehicle infrastructure. It operates in more than one country, thus has become an internationally recognized name in energy. for More visit https://www.tatapower.com/.

- Interesting Fact: It owns one of India’s largest solar rooftop installations and has significant investment into the access of sustainable energy at every level of consumer reach.

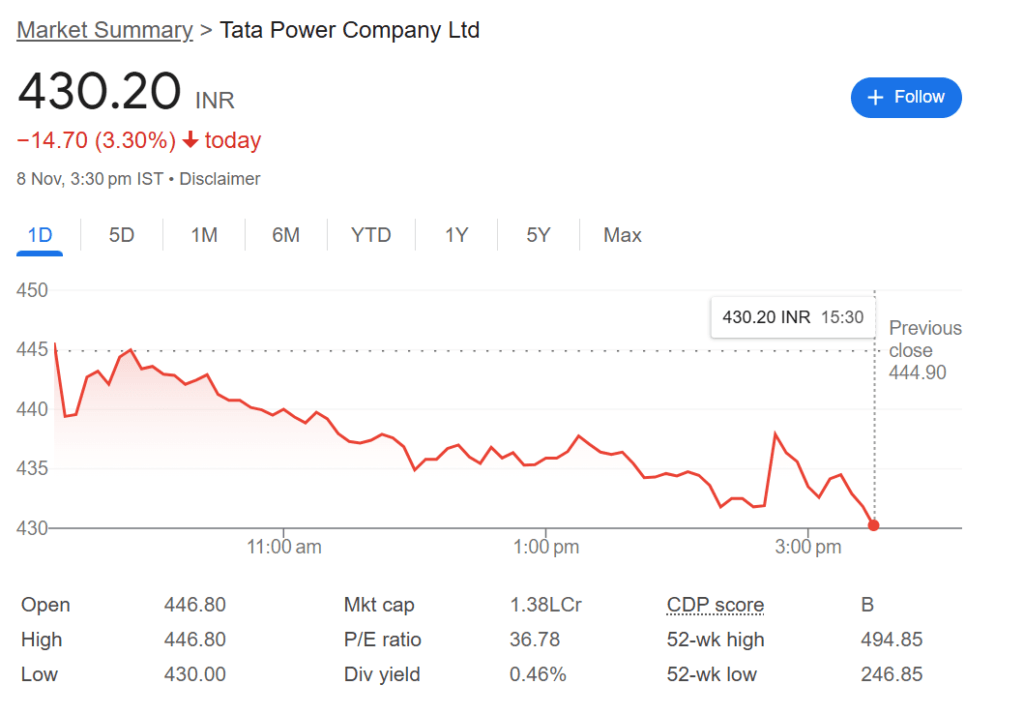

Tata Power Share Price In Recent: 2024 Analysis

Here is the information on Tata Power share price in 2024.

| Metric | Value |

|---|---|

| Current Price | 430.20 INR |

| Change | -14.70 (-3.30%) |

| Date/Time | 8 Nov 2024, 3:30 pm IST |

| Open | 446.80 |

| High | 446.80 |

| Low | 430.00 |

| Market Cap | 1.38 Lakh Crore |

| P/E Ratio | 36.78 |

| Dividend Yield | 0.46% |

| CDP Score | B |

| 52-Week High | 494.85 |

| 52-Week Low | 246.85 |

Tata Power Share Price Target 2025: Overview

Analysts have projected that Tata Power share price target 2025 would be between the range of ₹515-₹745, since the project of renewable sources of energy and the promises of incentives from the governments in green energy initiatives were stated to have driven the scope.

- Tata Power is a big-cap stock that is traded in both NSE and BSE. Recently, the company has received ample attention from the public following its aggressive push toward clean energy and innovative technologies, impacting the positive movement of their stock prices.

- Its prospects attract investors, especially due to the Indian government’s increased focus on renewable sources of energy. The stock has been stable, tends to appreciate in growth market phases, and is considered a relatively safe investment in the utility sector.

Tata Power Share Price Target 2025 to 2030: Comparison and Future Prospects

We can see how the share price of Tata Power has been increasing steadily year by year with strategic investments and aligning with India’s energy goals.

Here’s a quick overview of its price projections:

- 2024: ₹490 to ₹530

- 2025: ₹515 to ₹745

- 2030: ₹900 to ₹1200,

| Share Price Target (₹) | Year |

|---|---|

| ₹585 | 2025 |

| ₹669 | 2026 |

| ₹766 | 2027 |

| ₹878 | 2028 |

| ₹1005 | 2029 |

| ₹1200 | 2030 |

As the rest of the world continues shifting towards renewable energy.

In recent times, the strategy chosen by Tata Power toward the path of sustainability suits current as well as future trends concerning energy. Specifically, reaching net-zero emission goals has been a cornerstone in Indian policies, where it set 2070 as its deadline. Long-term values thus bode well with rising demand for sources from natural elements.

Tata Power Shareholding Data

Here is the Shareholding Data of Tata Power Shares.

| Category | Percentage |

|---|---|

| Promoters | 46.86% |

| Retail And Others | 27.03% |

| Foreign Institutions | 9.17% |

| Mutual Funds | 9.13% |

| Other Domestic Institutions | 7.82% |

Key Factors of TATA Power:

The share price of TATA Power in 2025 will depend on several key factors, including:

- Market Conditions: Overall trends in the stock market and investor sentiment can significantly influence share prices. Economic stability, inflation rates, and interest rates will play a role.

- Regulatory Environment: Changes in government policies regarding renewable energy, tariffs, and subsidies can impact TATA Power’s operations and profitability.

- Growth in Renewable Energy: TATA Power’s strategic focus on expanding its renewable energy portfolio, including solar and wind projects, is crucial. Success in these ventures can enhance its market position.

- Financial Performance: Revenue growth, profitability, and cost management will directly affect investor confidence and share price. Quarterly earnings reports will be closely monitored.

- Competition: The energy sector is competitive, and TATA Power’s ability to maintain its market share against rivals will influence its valuation.

- Technological Advancements: Innovations in energy generation and distribution, especially in clean energy, can improve operational efficiency and profitability.

- Global Economic Factors: International energy prices and global economic conditions can also impact TATA Power’s operations and stock performance.

These factors combined will shape investor expectations and influence TATA Power’s share price in 2025.

Potential Scope of Investment in the Future: Profit and Loss Areas

As has already been mentioned above, every investment carries with it profit as well as loss-generating prospects. The Tata Power stock also performs this factor with some scope for the gain and a bit on the loss-making side too.

Profit Areas:

- The increasing renewable energy projects, primarily solar and wind power, are experiencing a strong growth.

- Government incentives towards green energy may help in increasing the profit margins and value of the stock.

- Tata Power is an early mover in electric vehicle infrastructure. This could be a good entry point into emerging sectors.

Loss Areas:

- Relying on government policies and changes in regulations can hamper the growth rate of renewable energy adoption.

- Raw material price volatility, in particular the lithium and other minerals required for the making of a battery.

- A high up-front investment into green infrastructure that does take time to pay off

Tata Power’s equity performance has been generally quite robust. However, the above-mentioned are a few aspects that an investor needs to keep in perspective while reviewing the long-term growth outlook.

Conclusion

The stock promises to be a bright green energy stock and a sound long-term prospect. Strongly pushed toward renewable energy,the company is positioned to capitalise on future energy trends. For investors seeking sustainable growth, Tata Power offers a highly compelling option in India’s rapidly evolving power sector.