NHPC Limited is one of the largest hydropower development companies in India and is a known name to the investors in sustainable energy stocks. By tracking “NHPC share price target 2025,” there can be an outlook into its scope in the renewable energy market. Here is an engaging guide by looking into the history of NHPC, its performance, and future prospects to attract prospective investors.

What is NHPC? A Brief History and Overview

The National Hydroelectric Power Corporation, or NHPC, was established in the year 1975 in India under the Ministry of Power. It was mainly set up to plan, promote, and organise hydropower development.

This has been a cornerstone over the years in India’s renewable energy portfolio. They expanded their reach beyond hydropower to develop various renewable energy projects to become a pioneer in clean energy.

It maintains and runs some of India’s large hydro projects. This, in turn, greatly meets the power demand of the country. The company is a giant entity that seeks cleaner and greener sources, which is, therefore, an eco-friendly approach to sustainable energy production.

NHPC in the Stock Market: Share Value and Investment Worth

NHPC made its debut on the stock market through its Initial Public Offering in 2009, and subsequently, the shares are listed on both Bombay Stock Exchange and National Stock Exchange.

For conservative investors who look for a renewable sector with growth, NHPC’s share is one such attractive one as recently, the value of the shares has remained well within the price range of ₹60 to ₹80.

The NHPC share price target 2025 needs to be accessed as the company is consistently enhancing its renewable energy generation. NHPC has always been a low-risk stock among investors because of support from the government and relatively stable hydroelectricity.

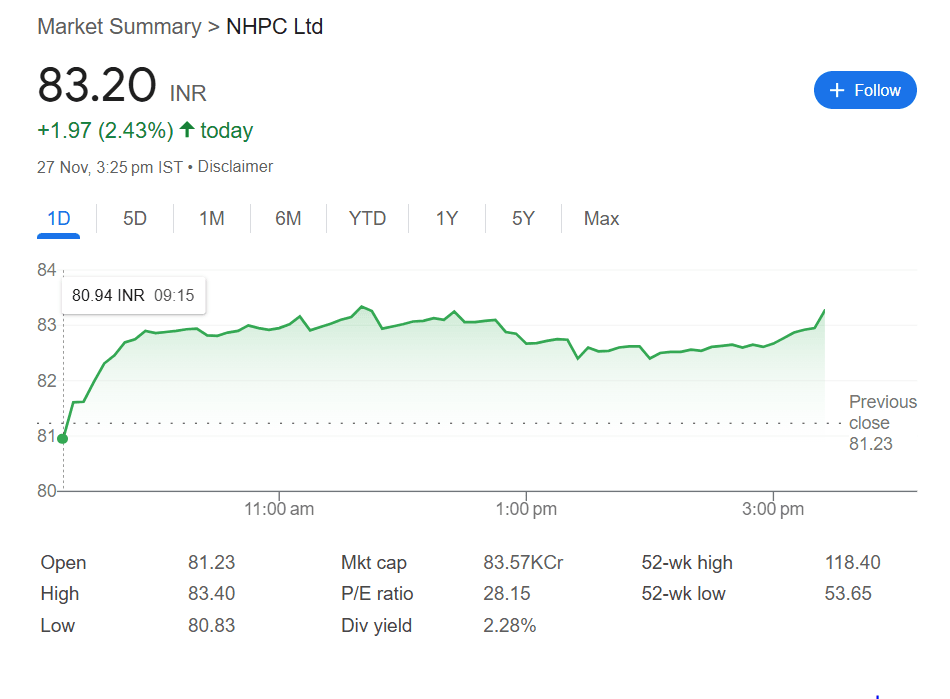

NHPC Share Price Analysis in 2024

| Metric | Value |

|---|---|

| Current Price | 83.20 INR |

| Change (Today) | +1.97 (2.43%) |

| Previous Close | 81.23 |

| Open Price | 81.23 |

| High | 83.40 |

| Low | 80.83 |

| Market Cap | 83.57K Cr |

| P/E Ratio | 28.15 |

| 52-Week High | 118.40 |

| 52-Week Low | 53.65 |

| Dividend Yield | 2.28% |

NHPC Share Price Target 2025: Comparison and Future Prospects

Based on estimated projections, share price of NHPC graph will be in an ascending pattern as the company is looking to diversify its profile of renewable energy. Compare this snapshot:

- 2024: ₹45-₹50

- 2025: ₹55-₹65

- 2026: ₹70-₹80

| Year | Share Price Target (₹) |

|---|---|

| 2024 | (₹) 100 |

| 2025 | (₹) 132 |

| 2026 | (₹) 155 |

| 2027 | (₹) 186 |

| 2028 | (₹) 267 |

| 2029 | (₹) 291 |

| 2030 | (₹) 318 |

This means that there is a betterment in the chances of continuous growth, especially since NHPC is venturing into hydro and solar power ventures.

With the Indian government shifting towards renewable energy, a healthy stock price of the NHPC share price has been forecasted to reflect on the coming years. Therefore, it will be worthwhile to invest in NHPC when one is looking at sustainability options for long-term investments.

NHPC Shareholding Pattern

| Category | Percentage (%) |

|---|---|

| Promoters | 67.40 |

| Retail And Others | 13.45 |

| Foreign Institutions | 9.38 |

| Other Domestic Institutions | 6.15 |

| Mutual Funds | 3.63 |

Determinants Influencing NHPC Share Price

Many factors have influenced NHPC’s share price over the time. Amongst the various, the following one affects changes in stock prices about the NHPC share price:

- Government Policies: Because of being a company that owns the government itself, there is an undeniable closeness between its governmental policies and business growth. Whenever favourable policies in regard to supporting renewable energy sources occur or subsidies, their stock market directly influences its share value.

- Renewable Energy Demand: Since renewable energy demand, most particularly hydroelectric power demand, is linked to its profitability and performance in the market, NHPC enjoys a good advantage as all the world shifts towards renewable energy.

- Project Developments: The completion of the new projects or expansions have also been a matter of major influence on NHPC share price. Completing such projects in time not only increases revenue but also ensures investor confidence.

- Environmental Factors: Hydropower needs water flow and stable climatic conditions. To this extent, NHPC relies on the natural resource of water. However, it also spends on other renewable resources. So the risk factor gets balanced here.

All the above reasons indicate that NHPC is at the hands of policy as well as natural phenomena. However, the above factors have well positioned this company, primarily because it has invested in renewable sources and the governmental support given to it.

Future Scope of Investment: Profit and Loss Potential

The advantages and risks associated with investment in NHPC shares as mentioned below-

Potential Returns:

- Government Support: Being a state-owned enterprise, the company is a beneficiary of the regulatory support and incentives offered, which lowers the risk factor.

- Increasing Demand for Clean Energy: As there is an increase in the demand for clean energy in the world, NHPC’s business in hydropower goes well with future needs of energy.

- Stable Returns: NHPC projects come with stable returns, thereby making it an attractive avenue for conservative investors who seek stability in returns.

Loss Potential:

- Weather Dependency: A hydroelectric business model depends on steady rainfall and adequate water supply to determine power generation and thus profits.

- Slow Growth Pace: Growth in NHPC is much slower than the newer green energy sectors of solar and wind. Those wanting to make quick money seem to find NHPC more staid.

- Regulatory Risks : Despite the support, NHPC is vulnerable to policy flips if government priorities in an energy transition change.

The investment appeal of NHPC lies in low-risk steady growth. The company is particularly attractive to investors with longer horizons who are willing to sacrifice quick gains for stability.

Conclusion

NHPC share price is a great promise for conservative investors with an interest in renewable energy. NHPC has exhibited steady growth in hydroelectric power and the government has a support base for the company, so it can be a long-term investment for the portfolio. In this regard, as the world shifts toward green energy, NHPC will remain a stable option in the renewable sector.

Also, Read About:- Suzlon Share Price Target 2025 to 2030: Target, Analysis and More